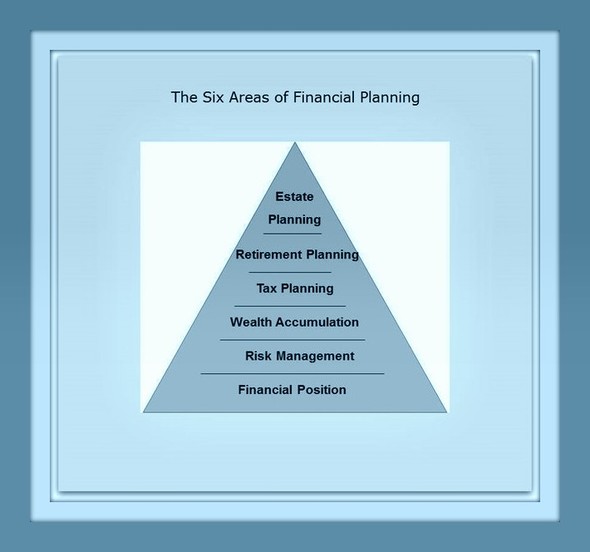

Financial Planning Pyramid

1. Financial Position

Where does your money come from and where does it go? Savings and Investments - Fixed Expenses - Variable Expenses

2. Risk Management

What risks are you exposed to that could sink your financial ship? Risk management addresses insurance issues.

3. Wealth Accumulation

Save money for specific goals, on purpose and make informed decisions. These investments tend to be known as non-qualified monies. They are usually after tax investment dollars.

4. Tax Planning

The goverment is in partnership with you. Review and understand your 1040 Return. Know that we have two tax systems. The income tax and the estate & gift tax.

5. Retirement Planning

Build net worth through systematic savings and invest it wisely. These dollars are referred to as qualifies money since they are usually in a qualified retirement plan.

6. Estate Planning

How your estate passes can be in your control. It is important to understand how title affects ownership and the rights of a beneficiary designation. Address guardianship issues for young children. Which estate planning documents should you have? Plan for the worst case scenario and you'll find financial confidence.